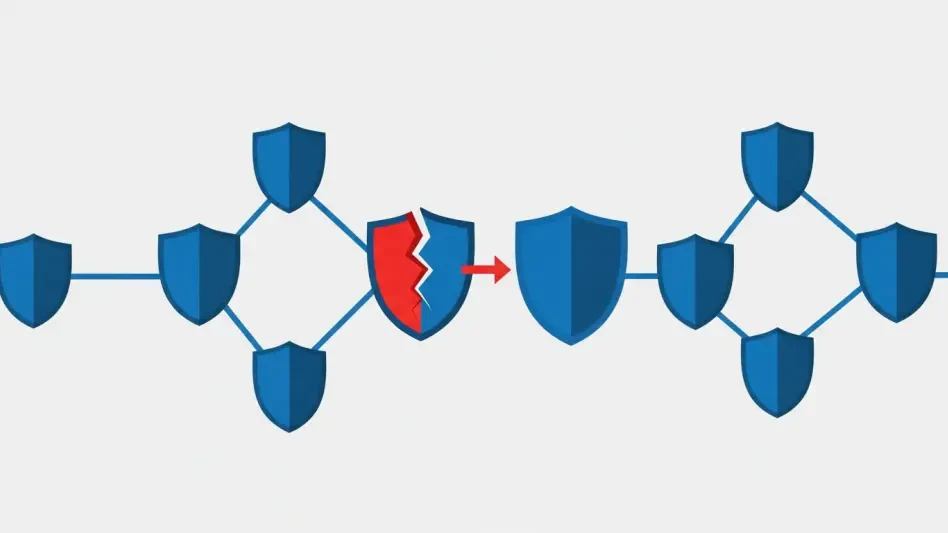

In recent years, the insurance industry has faced a growing menace in the form of ransomware attacks, with cybercriminal groups like Scattered Spider setting their sights on this lucrative sector. Known for their deliberate focus on strategic industries, these groups exploit vulnerabilities within the insurance ecosystem, signaling an urgent need for robust defense mechanisms and heightened vigilance. The threat landscape is rapidly evolving, necessitating a comprehensive examination of the industry’s preparedness and response capabilities.

Overview of the Insurance Industry

The insurance industry stands as a critical component of the global economy, encompassing a vast range of services that protect consumers and businesses against financial loss. With segments such as life, health, property, and casualty insurance, the scope of the industry is immense, supporting risk management worldwide. Technological advancements influence the sector significantly, enhancing customer experiences while also introducing new vulnerabilities. Major market players and stringent regulations shape industry practices, emphasizing transparency, accountability, and security.

Current Trends in the Insurance Sector

Industry Trends and Innovations

The insurance industry is undergoing transformative changes, driven by technological innovations and shifts in consumer behaviors. Artificial intelligence, blockchain, and data analytics are among the technological drivers fostering efficiency, personalized services, and new business models. Consumers increasingly demand seamless digital experiences, prompting insurers to adapt and innovate. These advancements create opportunities but also necessitate strengthened cybersecurity measures to protect sensitive client information and ensure regulatory compliance.

Market Data and Future Projections

Recent market data and analysis suggest steady growth in the insurance sector, with projections indicating continued expansion in the coming years. Key performance indicators reveal increasing premiums, higher claim volumes, and robust capitalization trends. The industry is poised for further development, with emerging markets and digital solutions presenting promising avenues for growth. Nonetheless, the threat of ransomware remains a looming challenge, compelling stakeholders to invest in cybersecurity initiatives to safeguard future prospects.

Challenges Facing the Insurance Industry

The insurance sector grapples with a myriad of challenges, ranging from technological vulnerabilities to complex regulatory environments. The digital transformation, while beneficial, introduces opportunities for cybercriminal activities, making data security a critical concern. Regulatory requirements demand rigorous compliance efforts, adding complexity and cost to operations. Addressing these challenges requires strategic investment in technology, ongoing staff training, and comprehensive incident response planning to mitigate risk effectively.

Regulatory Environment and Compliance

The regulatory landscape in the insurance industry is characterized by intricate laws, standards, and compliance mandates aimed at safeguarding consumer interests and maintaining market stability. Regulatory bodies enforce strict data protection and privacy requirements, prompting insurers to implement advanced security measures. These regulations also influence operational practices, necessitating regular assessments and updates to ensure continued adherence. Compliance not only protects against legal repercussions but also enhances trust and credibility among policyholders.

Future Outlook of the Insurance Industry

Looking ahead, the insurance industry is on the brink of substantial transformation, driven by emerging technologies and shifting market dynamics. Innovations such as the Internet of Things (IoT) and artificial intelligence promise to redefine insurance processes, enabling more accurate risk assessments and tailored offerings. However, potential disruptors, including cyber threats and changing consumer preferences, threaten to reshape the landscape. Embracing innovation, maintaining regulatory focus, and adjusting to global economic conditions will be crucial for the industry’s sustained growth.

Conclusion and Recommendations

The insurance sector faces a cybersecurity crossroad, with ransomware attacks serving as a stark reminder of existing vulnerabilities. Protection of customer data and the integrity of operations are paramount and require an industry-wide strategic response. The focus on strengthening cybersecurity frameworks, fostering collaboration with technology and security experts, and enhancing staff awareness can create a resilient defense against threats. The future demands a pursuit of innovative solutions, proactive regulation compliance, and continuous adaptation to an ever-evolving technological landscape to safeguard the integrity and growth of the insurance industry.