The already fraught process of purchasing a home in the United Kingdom has become burdened by a new and growing anxiety, as a recent survey reveals that 62 percent of consumers now fear their identity could be compromised by fraudsters using sophisticated artificial intelligence. This widespread concern stems from the increasing accessibility of AI tools capable of creating highly convincing fake identity documents and entirely synthetic personas, which can bypass conventional security checks. The rise of this technology represents a significant escalation in the battle against fraud, moving beyond simple document forgery into an era where deepfakes and AI-generated profiles pose a tangible threat to one of the most significant financial transactions in a person’s life. This creates a high-stakes environment where the integrity of personal data is paramount, yet common practices for sharing that data have failed to keep pace with the evolving risks, leaving many homebuyers vulnerable.

The Paradox of Consumer Behavior in a High-Risk Environment

Despite the heightened awareness and fear surrounding AI-driven identity theft, a critical vulnerability lies in the contradictory behavior of consumers themselves. The very individuals expressing concern are often the ones engaging in high-risk data-sharing practices. Research indicates that a majority of people, 62 percent, routinely use email to send sensitive identity documents, while an additional 10 percent rely on messaging applications such as WhatsApp. These methods are fundamentally unsuited for transmitting such critical information, as they typically lack the end-to-end security protocols and, crucially, the verifiable audit trails required to meet compliance standards for financial transactions. This disconnect is further amplified by the fact that 58 percent of individuals admit they are unsure who is accessing their data after it has been sent. This creates a stark paradox, given that an overwhelming 86 percent of people state that having direct control over how their personal information is shared is extremely important to them, revealing a significant gap between consumer desire for security and their actual day-to-day practices.

A Digital Response to an Evolving Threat

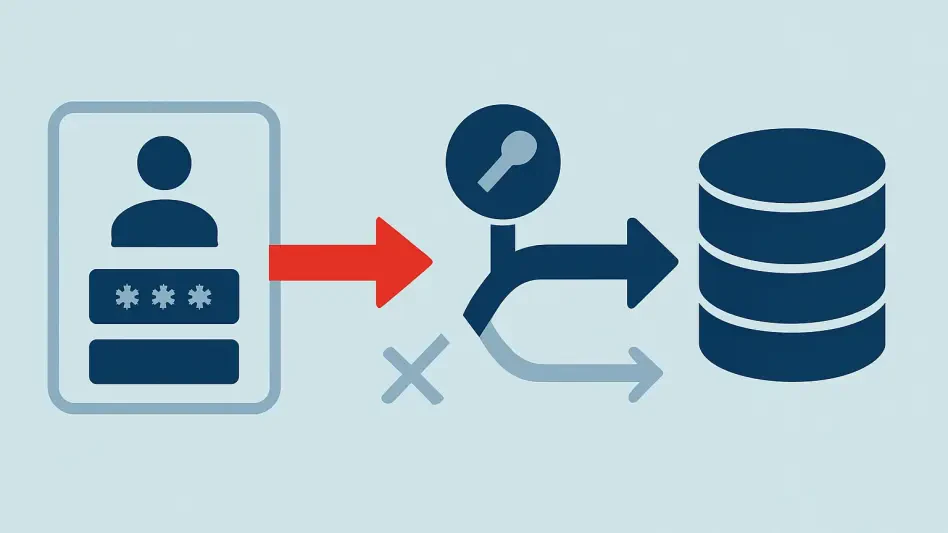

The escalating threat posed by AI-powered fraud prompted a necessary evolution in digital security, leading to the development of innovative solutions designed to restore trust and control. In response to this challenge, the industry saw the introduction of tools specifically engineered to serve as an antidote to AI-generated deception, such as the Compliance Wallet from Credas Technologies. This technology enabled users to establish a single, verified digital identity that consolidated all necessary compliance checks, including identity verification, anti-money laundering screenings, and sanctions lists. By leveraging advanced security measures like biometric facial recognition and Near Field Communication (NFC) for reading electronic chips in official documents, these systems provided a far more robust level of assurance. This model empowered individuals to complete a thorough verification process once and then securely share their certified profile with authorized parties. This shift not only provided a complete and transparent audit trail but also directly addressed the consumer demand for greater control over their personal data, marking a pivotal step toward fortifying transactions against a new generation of digital threats.