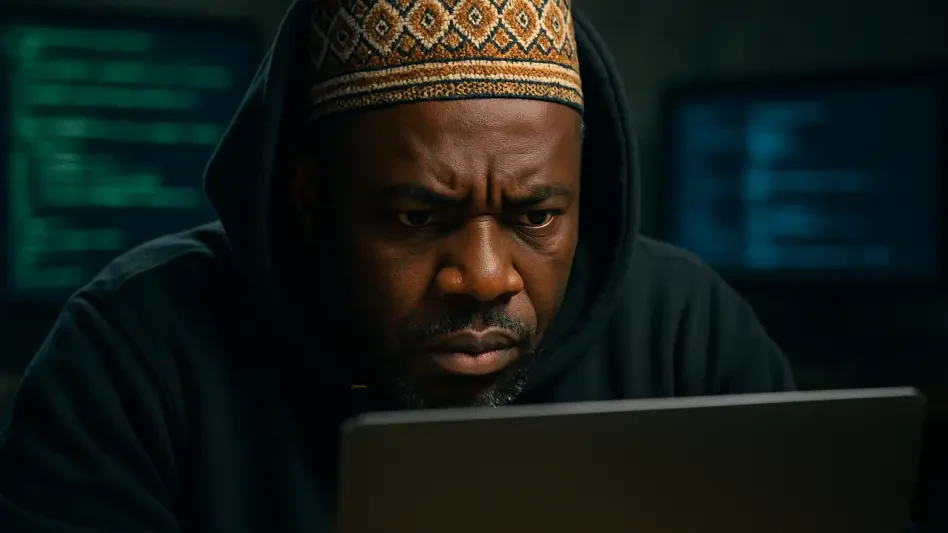

What happens when a single individual orchestrates a digital theft so audacious that it drains millions from a government agency like the IRS? The story of Chukwuemeka Victor Amachukwu, a 39-year-old Nigerian national, unveils a chilling tale of cybercrime that shook financial systems across the United States. Extradited from France to face justice, his alleged schemes reveal not just personal greed but a sophisticated, border-crossing operation that exploited digital vulnerabilities with ruthless precision. This saga raises a pressing question: how secure are the systems safeguarding sensitive financial data?

The significance of this case extends far beyond one man’s actions. It serves as a stark reminder of the escalating threat of cybercrime, a global epidemic costing economies billions each year. With identity theft and computer intrusions on the rise, Amachukwu’s alleged fraud—netting $2.5 million in fake tax refunds and targeting over $8.4 million more—highlights the urgent need for robust cybersecurity measures. This narrative isn’t just about a criminal; it’s about the gaping holes in digital defenses that affect businesses, individuals, and governments alike.

The Scale of Deception: A Multimillion-Dollar Fraud Unveiled

At the heart of this scandal lies a staggering financial blow to the IRS and state tax agencies. Between 2019 and the present, Amachukwu and his associates allegedly siphoned off $2.5 million through fraudulent tax refunds, with attempts to secure an additional $8.4 million. Their targets weren’t limited to government coffers; small businesses and unsuspecting investors also fell prey to their schemes, painting a picture of widespread devastation.

The audacity of the operation is matched only by its complexity. Operating from Nigeria, Amachukwu collaborated with co-conspirators like Kingsley Uchelue Utulu to exploit systemic weaknesses. Their success in evading detection for years underscores a troubling reality: cybercriminals are often steps ahead of traditional security protocols, using technology as both a weapon and a shield.

This isn’t just a story of numbers—it’s a wake-up call. The financial toll reflects countless personal losses, from businesses struggling to recover to individuals whose identities were stolen. As cybercrime continues to evolve, cases like this demand attention to prevent similar heists from striking even closer to home.

Global Shadows: Why Cross-Border Cybercrime Threatens Everyone

Cybercrime no longer respects geographic boundaries, and Amachukwu’s case exemplifies this dangerous shift. His alleged activities, spanning multiple countries, reveal how digital fraudsters operate in a borderless realm, exploiting gaps in international law enforcement coordination. With losses from cybercrime globally estimated at over $8 trillion annually, the stakes couldn’t be higher for nations to unite against such threats.

The impact hits hardest at the local level. Small businesses, already grappling with economic challenges, became easy targets for Amachukwu’s crew, losing critical funds through schemes like the fraudulent Economic Injury Disaster Loan claims worth over $819,000. These attacks ripple outward, eroding trust in digital transactions and financial systems that underpin daily life.

Beyond the immediate victims, this case signals a broader crisis. As cybercriminals grow bolder, leveraging tools like spearphishing and malware, the average person’s data becomes a commodity on the dark web. The fight against such threats requires not just technology but a global commitment to outpace the ingenuity of fraudsters.

Anatomy of a Scam: Dissecting the Fraudulent Tactics

Delving into the mechanics of Amachukwu’s operation reveals a chilling blueprint for digital theft. His group allegedly used spearphishing emails to infiltrate tax preparation firms in states like New York and Texas, with a notable breach in 2021 infecting a New York firm’s systems with malware. This allowed them to steal personal data, file false tax returns, and redirect millions in refunds to their accounts.

Their schemes didn’t stop at tax fraud. The conspirators also manipulated stolen identities to secure over $819,000 from the Small Business Administration’s loan programs, preying on relief efforts meant for struggling businesses. This multi-layered approach—combining technical hacks with social engineering—demonstrates a calculated effort to maximize financial gain at every turn.

Perhaps most brazen was Amachukwu’s separate venture into investment fraud. By promising lucrative returns on nonexistent opportunities, he allegedly duped individuals out of millions, exploiting trust as easily as he exploited technology. Such diverse tactics highlight the adaptability of modern cybercriminals, posing a daunting challenge to those tasked with stopping them.

Justice in Pursuit: Law Enforcement’s Stance on Cybercrime

The response from authorities offers a glimpse of resolve amid the chaos of digital fraud. “No matter where you hide, accountability will follow,” declared an FBI spokesperson, reflecting the determination to bring cybercriminals to justice. Amachukwu faces severe charges, including wire fraud and aggravated identity theft, with a potential sentence of up to 47 years in prison if convicted.

International collaboration proved critical in his capture. The joint efforts of the FBI, the Justice Department’s Office of International Affairs, French authorities, and the U.S. Marshals Service showcase a united front against borderless crime. Prosecutors emphasize that such partnerships are vital to tracking down individuals who operate from distant shores yet inflict local harm.

Legal experts stress that harsh penalties alone aren’t enough. The complexity of Amachukwu’s alleged crimes calls for evolving strategies, from advanced cyber forensics to stronger extradition agreements. This case may set a precedent, signaling to fraudsters worldwide that evasion is no longer a guarantee in the face of global cooperation.

Safeguarding Your Future: Defenses Against Digital Threats

Amid the sophistication of schemes like Amachukwu’s, individual and business protection becomes paramount. A simple yet effective step is scrutinizing every email—spearphishing remains a primary gateway for hackers, often disguised as legitimate correspondence. Avoiding clicks on suspicious links or attachments can thwart initial breaches that lead to larger losses.

Strengthening personal security measures offers another layer of defense. Using complex, unique passwords alongside two-factor authentication for financial and professional accounts significantly reduces risks. Regular monitoring of bank statements and tax filings for unauthorized activity ensures early detection of potential fraud, limiting damage.

For businesses, the stakes demand even greater vigilance. Investing in cybersecurity tools and training staff to spot phishing attempts can prevent disasters like the 2021 New York firm breach. Staying proactive, rather than reactive, transforms potential victims into fortified targets, disrupting the calculations of cybercriminals seeking easy prey.

Reflecting on a Digital Reckoning

Looking back, the saga of Chukwuemeka Victor Amachukwu stands as a sobering chapter in the battle against cybercrime. His alleged actions, which bled millions from government programs and private citizens alike, exposed the fragility of digital systems once thought secure. The international manhunt that led to his extradition marked a triumph, yet also a reminder of the persistent challenges in this arena.

Moving forward, the focus must shift to innovation and collaboration. Governments and the private sector alike need to invest in cutting-edge cybersecurity defenses, while individuals must adopt a mindset of constant caution in their online interactions. Strengthening legal frameworks to ensure swift justice for cross-border crimes remains a critical piece of the puzzle.

Ultimately, this case urges a collective push toward resilience. By learning from past breaches and prioritizing prevention over recovery, society can build a future where digital trust is no longer a vulnerability but a fortified asset. The fight against cyber fraud demands nothing less than a unified, relentless effort to stay ahead of those who exploit the shadows of technology.