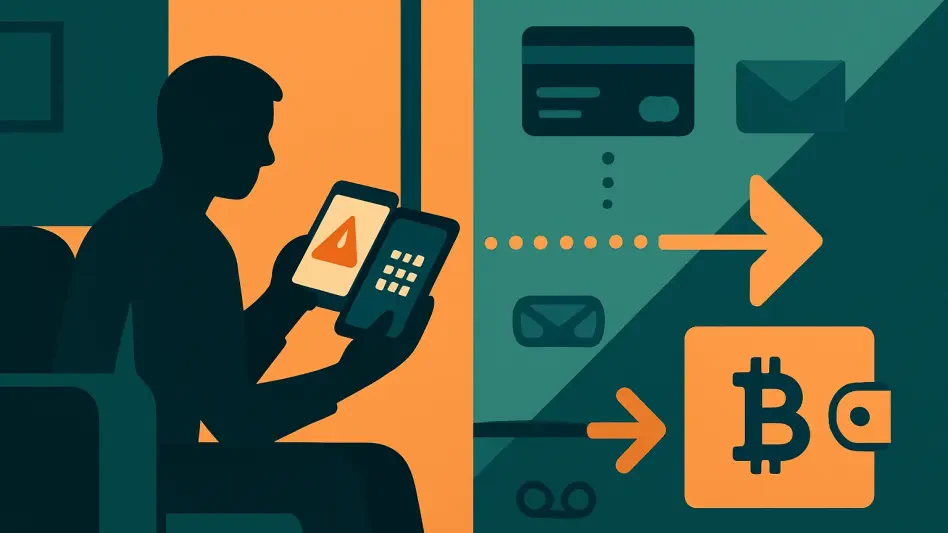

A phone rings at dinner, a text pings with an urgent alert, and within minutes a savings balance evaporates as a calm “specialist” guides a worried customer through supposed security steps that quietly undo account protections and turn multi-factor authentication into a weapon against itself. Since January, the FBI documented more than 5,100 complaints tied to account takeover schemes and at least $262 million in losses, a wave defined less by hacking tools than by rehearsed social scripts and convincing impersonations. The pitch is familiar: suspicious charges, frozen cards, compromised logins. The channels shift—email, texts, spoofed sites, live calls—but the cadence is constant: urgency, authority, and the promise of quick resolution. Once a victim types a one-time passcode, attackers reset credentials, lock out the actual owner, and push funds through wires that land in accounts linked to cryptocurrency wallets, where speed and opacity complicate recovery.

Inside the surge: how impostors beat MFA in real time

The sophistication lies in choreography rather than code. Fraudsters mirror the look and language of banks, copy phone trees, lift logos, and script calls that escalate from “verification” to outright control. When targets hesitate, a second impostor may enter as “fraud prevention” or even pose as law enforcement, layering pressure with badge numbers and threats of additional losses if the victim delays. Meanwhile, the technical playbook remains straightforward: initiate a real login to trigger an MFA challenge, capture the one-time passcode in the moment, and pivot into password resets that automatically sign out legitimate devices. Email accounts and voice mail become collateral, as recovery messages and reset links are intercepted. Funds exit quickly via wire transfers and, in many cases, traverse crypto-linked rails that fragment traceability, letting criminals monetize gains before internal controls or weekend delays slow the chase.

What effective response required now

Defenses worked best when decisions moved as fast as the theft. Immediate calls to the financial institution enabled recalls or reversals, and documented requests for a Hold Harmless Letter or a Letter of Indemnity strengthened internal reviews that prioritized retrieval. Parallel notifications to the impersonated institution helped shut down spoofed numbers and domains, cutting off ongoing campaigns, while prompt reports to the IC3 created investigative trails that linked related incidents across regions and banks. Institutions that trained teams and customers to distrust urgency, verify via trusted channels, and isolate devices before re-authentication saw better outcomes. Moreover, layered controls—transaction alerts, transfer limits, step-up verification for new payees, and out-of-band confirmations—reduced blast radius. The takeaway landed clearly: response plans had to be rehearsed, communication trees prebuilt, and escalation paths defined, because hesitation often decided whether stolen funds remained recoverable.