Imagine a digital world where billions of dollars vanish into thin air, only to resurface in the hands of cybercriminals with no trace of their origin. This isn’t a sci-fi thriller—it’s the reality of cryptocurrency mixing services, tools that obscure the flow of digital funds through complex mechanisms. As blockchain technology promises transparency, mixers exploit it to create anonymity, becoming a critical asset for illicit actors. This review dives into the intricate workings of these services, evaluating their technology, their impact on cybercrime, and the global efforts to rein them in. The stakes couldn’t be higher, as law enforcement races to keep pace with an ever-evolving threat to financial security.

Understanding the Technology Behind Mixers

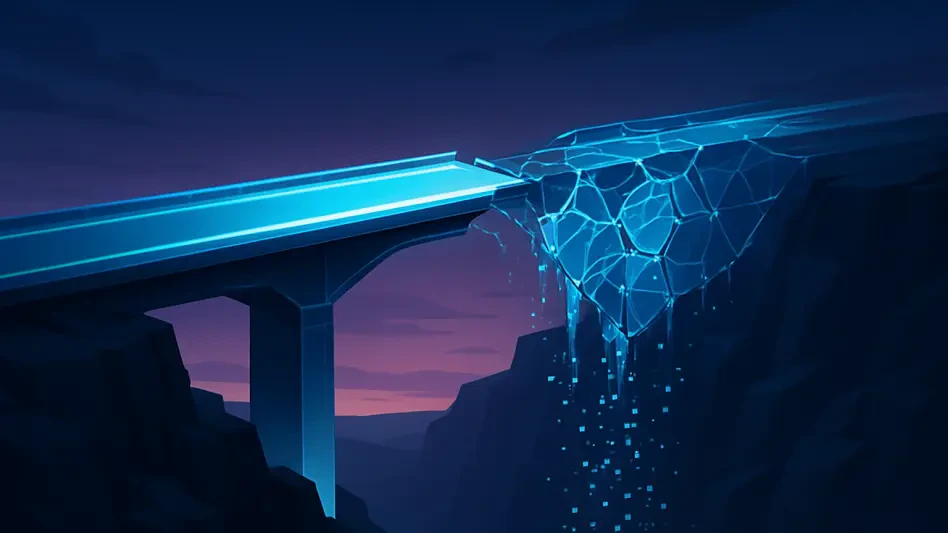

Cryptocurrency mixers operate on a deceptively simple premise: they blend funds from multiple sources to break the link between sender and recipient. By pooling deposits from various users into a single pot, these services hold the funds for unpredictable durations before redistributing them to different addresses. This process takes advantage of the public ledger nature of cryptocurrencies like Bitcoin, turning transparency into a shield for anonymity. The result is a transaction trail so muddled that even sophisticated blockchain analysis struggles to untangle it, making mixers a go-to for those looking to hide their tracks.

Beyond the basic concept, the appeal of these tools lies in their ability to operate at scale with minimal oversight. Many services are decentralized or hosted on the dark web, further complicating efforts to shut them down. Their design prioritizes user privacy—or, more often, criminal intent—over compliance with financial regulations. This raises tough questions about the balance between individual freedom in digital finance and the need to prevent abuse, a debate that continues to shape the landscape of cryptocurrency governance.

Performance and Real-World Impact

When assessing the performance of cryptocurrency mixers, their effectiveness in evading detection stands out as both impressive and alarming. Services like the recently dismantled Cryptomixer have processed staggering sums—over 1.3 billion euros (approximately $1.5 billion)—demonstrating their capacity to handle high-volume laundering for ransomware gangs and dark web markets. The technical prowess of these platforms lies in randomized timing and distribution patterns, which frustrate even the most advanced tracking tools used by law enforcement and blockchain analysts.

However, the real-world implications paint a darker picture. Reports from firms like TRM Labs highlight how state-sponsored actors, such as North Korean hackers, rely on mixers to obscure stolen funds. A notable trend shows these groups shifting toward faster, automated laundering techniques, adapting to heightened scrutiny. This cat-and-mouse game between criminals and authorities underscores a critical flaw: while mixers excel at concealment, they also expose the vulnerabilities in a financial system still grappling with regulation.

The societal cost of this technology cannot be overstated. Beyond individual crimes, the anonymity provided by mixers fuels a broader ecosystem of cybercrime, enabling everything from data breaches to extortion schemes. Each successful operation—until disrupted by initiatives like Operation Olympia—erodes trust in digital currencies as a legitimate financial tool. This duality of innovation and exploitation remains at the heart of the discussion around their role in modern tech.

Global Efforts to Counter the Threat

Recent crackdowns reveal a determined push to curb the misuse of mixing services. Operation Olympia, a joint effort by Swiss and German authorities with Europol’s support, struck a major blow by seizing Cryptomixer’s servers and domain in late November. With over 12 terabytes of data and 25 million euros in Bitcoin confiscated, this operation showcases the growing sophistication of international cooperation. It follows the 2023 takedown of ChipMixer, where nearly $50 million in Bitcoin was captured, signaling a consistent strategy to target financial anonymity at its core.

Yet, challenges persist in this ongoing battle. The adaptability of cybercriminals, coupled with jurisdictional gaps, often outpaces regulatory frameworks. Legal actions, such as the sentencing of Samourai Wallet’s co-founders by the U.S. Department of Justice, aim to hold operators accountable, but the decentralized nature of many mixers complicates enforcement. Each victory, while significant, reveals the depth of a problem where technology evolves faster than the systems designed to police it, pushing authorities to innovate relentlessly.

Final Thoughts and Path Forward

Looking back, the saga of cryptocurrency mixing services unfolded as a stark reminder of technology’s dual nature—capable of both empowering and endangering. Operations like Olympia and the ChipMixer takedown marked pivotal moments, exposing the scale of illicit funds flowing through these platforms and the determination of global law enforcement to disrupt them. Each seizure and prosecution chipped away at the infrastructure supporting cybercrime, even as adversaries adapted with new tactics.

Moving ahead, the focus must shift to proactive measures that outpace criminal ingenuity. Governments and tech firms should prioritize developing advanced blockchain analytics to detect obscured transactions before they proliferate. Collaborative frameworks, building on the success of international partnerships, need expansion to close regulatory loopholes. Equally vital is fostering public awareness about the risks of unregulated digital finance, ensuring that innovation doesn’t come at the cost of security. The fight against mixers is far from over, but with sustained effort, the balance can tilt toward a safer digital economy.