The pervasive threat of sophisticated fraudulent schemes has become an undeniable crisis, weaving a complex web of deceit that ensnares millions of citizens and extracts a devastating financial and emotional toll. As technology has advanced, so too have the methods of criminals, who now leverage social media, artificial intelligence, and digital communication platforms to execute scams with unprecedented scale and believability. These are not isolated incidents of petty crime; they represent a coordinated, multi-billion-dollar illicit industry that preys on trust and exploits vulnerabilities in our increasingly connected world. The challenge is no longer simply about avoiding suspicious emails but about navigating a digital landscape where distinguishing genuine communication from a malicious trap has become exceedingly difficult for the average person. Government agencies and independent research groups consistently report a troubling upward trend in both the volume of scams attempted and the staggering sums of money lost, painting a grim picture of a nation under siege from an ever-evolving digital menace that threatens the financial security of every demographic.

1. The Escalating Financial Devastation

The economic impact of this widespread fraud has reached staggering proportions, with verifiable losses climbing into the tens of billions of dollars annually. Data from recent years paints a stark reality of the financial devastation inflicted upon the American public. An analysis supported by AARP revealed that identity fraud and related scams cost Americans an estimated $47 billion in 2024 alone, a figure that underscores the severe vulnerability of personal and financial data. Furthermore, broader surveys attempting to capture the full scope of the problem, including incidents that go unreported, placed the total cost of scam exposure at approximately $64 billion in 2025. The Federal Bureau of Investigation (FBI) has also highlighted the significant financial drain from cybercrime, which encompasses a wide array of digital scams, with reported losses fluctuating between $16 billion and $16.6 billion in 2024. These figures, while immense, only represent the documented cases and fail to capture the full economic and psychological damage.

Compounding the crisis is the critical issue of underreporting, which means the already astronomical official figures almost certainly underestimate the true financial carnage. Many victims, overwhelmed by feelings of shame, embarrassment, or a sense of hopelessness, never file a formal complaint with law enforcement or regulatory bodies. This reluctance to report stems from various factors, including the fear of being judged, a belief that the lost funds are unrecoverable, or unfamiliarity with the proper channels for reporting such crimes. Consequently, the official statistics, as alarming as they are, reflect only the tip of the iceberg. The unreported losses contribute to a shadow economy of fraud that continues to thrive in the absence of complete data. This information gap not only masks the true scale of the epidemic but also hampers the ability of law enforcement agencies to track criminal networks, identify emerging trends, and allocate the necessary resources to combat these pervasive threats effectively.

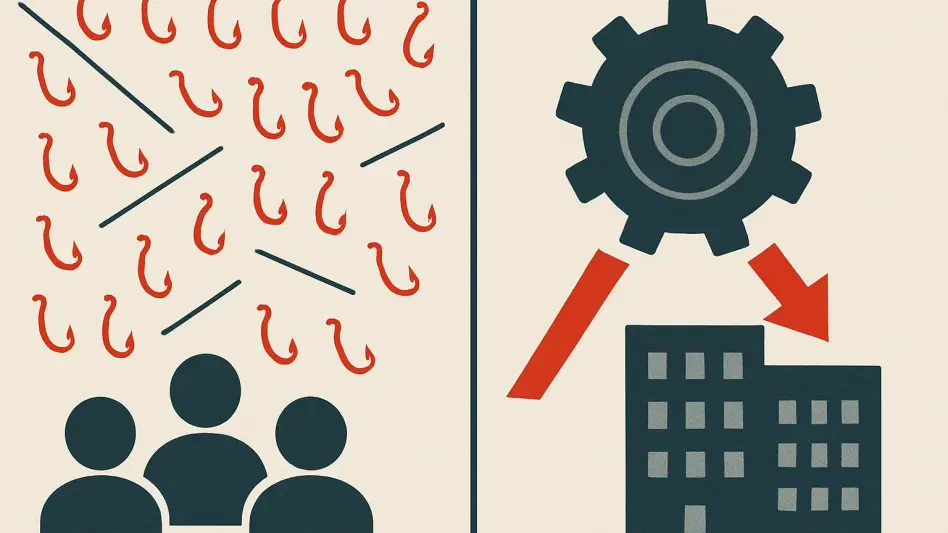

2. An Arsenal of Deceptive Tactics

Criminals employ a diverse and constantly evolving portfolio of schemes, with certain types of fraud standing out due to their prevalence and the sheer volume of financial damage they inflict. Among the most destructive are deceptive investment schemes, which lure victims with promises of high, guaranteed returns that are simply too good to be true. These include elaborate fake cryptocurrency platforms, classic Ponzi-style arrangements where new investors’ money is used to pay earlier ones, and fraudulent real estate deals. In 2024, reported losses from investment scams alone reached a breathtaking sum between $5 billion and $6 billion. Another pervasive category is online shopping and employment fraud. Scammers create sophisticated but fake e-commerce websites to steal payment information or set up bogus job offers that trick applicants into paying for background checks or providing sensitive personal data that can be used for identity theft.

Impersonation fraud remains one of the most common and emotionally manipulative tactics in a scammer’s arsenal, costing victims nearly $3 billion in 2024. In these scenarios, criminals pose as trusted figures to exploit a victim’s sense of duty or fear. They may call, text, or email pretending to be from a government agency like the IRS or the Social Security Administration, threatening legal action unless an immediate payment is made. Another common variant involves tech support scams, where fraudsters claim a person’s computer has been compromised and charge them for unnecessary or fake repair services. Perhaps the most cruel form of this scam is when criminals impersonate a family member in distress, often claiming to be a grandchild who has been arrested and needs bail money or has been in an accident and requires funds for medical bills. They may even use tactics like claiming to have a bad cold to explain why their voice sounds different, preying directly on the victim’s love and concern for their family.

3. Fortifying Defenses Against Fraud

While the sophistication of modern scams can be intimidating, a foundation of fundamental security habits can provide a powerful shield against the vast majority of fraudulent attempts. The single most effective defense is to fiercely protect personal information. Details such as Social Security numbers, bank account information, and credit card numbers should never be shared in response to an unsolicited phone call, text message, or email. If a communication claims to be from a legitimate organization like a bank or a government agency, the proper response is to end the interaction and independently verify the claim by calling the entity back using an official phone number found on a statement or their public website. Furthermore, maintaining a healthy dose of skepticism is crucial. Offers that promise extraordinary returns on an investment, announcements of unexpected lottery winnings, or urgent demands for payment tied to a supposed emergency should all be treated as immediate red flags.

Beyond behavioral adjustments, leveraging technological safeguards and fostering awareness are critical components of a comprehensive defense strategy. Individuals should commit to strong digital hygiene, which includes using complex, unique passwords for every important online account and enabling two-factor authentication wherever it is offered. This simple step adds a vital layer of security that can thwart unauthorized access even if a password is compromised. It is also essential to be wary of unconventional payment methods, as scammers often demand payment through gift cards, wire transfers, or cryptocurrency because these transactions are difficult to trace and reverse. On the educational front, people must take the initiative to learn about common scam tactics and red flags, such as pressure to act immediately, threats, or emotional manipulation, and share this knowledge with family members, especially those who may be more vulnerable. Finally, keeping all software and devices updated and using reputable antivirus and anti-phishing tools can help block malicious attempts before they ever reach the user.

4. The Path Forward Through Vigilance and Action

Successfully combating the scam epidemic required a multifaceted approach that integrated stronger enforcement with proactive public and private sector initiatives. Federal task forces made progress by targeting large-scale criminal enterprises, particularly those involved in cryptocurrency fraud and organized impersonation rings, leading to significant seizures of illicit funds. However, these efforts highlighted the need for a more robust legal framework to address the evolving nature of digital crime. This included calls for new legislation that would impose stricter penalties on the technology platforms and social media companies that facilitate the spread of scam advertising, thereby holding them more accountable for the fraudulent content they host. Enhancing identity verification standards across financial and digital services was also identified as a critical step to make it more difficult for criminals to open accounts or access resources using stolen information.

Ultimately, the fight against this pervasive threat underscored the reality that a significant reduction in harm was only achievable through a combination of diligent public awareness, consistent reporting, and unwavering enforcement. The scale of the problem was such that no single entity could solve it alone; it demanded a collaborative effort. Individuals were empowered through education to become the first line of defense, while financial institutions developed better safeguards to protect their customers. Law enforcement agencies, in turn, adapted their strategies to pursue criminals across international borders and in the complex digital realm. The journey to mitigate the impact of scams was a continuous one, but the collective resolve to protect citizens’ financial well-being laid the groundwork for a more secure future where such widespread fraud was no longer an accepted cost of modern life.